- #CRYSTALL BALL EXCEL TRIAL FOR MAC FOR MAC#

- #CRYSTALL BALL EXCEL TRIAL FOR MAC MANUAL#

- #CRYSTALL BALL EXCEL TRIAL FOR MAC SOFTWARE#

- #CRYSTALL BALL EXCEL TRIAL FOR MAC WINDOWS#

setupfilename includes the bit level (32-bit or 64-bit). setupfilename /s /v'CBUSERNAME' cbusername ' CBSERIALNUMBER cbserialnumber /qn'.

#CRYSTALL BALL EXCEL TRIAL FOR MAC SOFTWARE#

in RISK or Crystal Ball Interoperability with other Vose Software products. Oracle Crystal Ball is considered to be the easiest to use and industry-leading simulation, optimization and forecasting tool for Microsoft Excel.a must for. If you only have access to the Crystal Ball setup executable file, possibly through a download from the Web, you can perform a silent installation and license at the same time with this statement.

#CRYSTALL BALL EXCEL TRIAL FOR MAC FOR MAC#

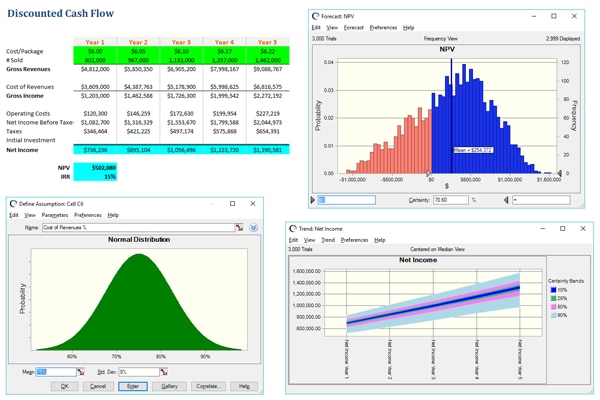

Visible Equations and Calculations in the customized options modules, allowing for Monte Carlo simulation, forecasting, and optimization, as well as linking and embedding formulas from other spreadsheets.Three easy-to-use Customized Options (Advanced, Manual, and Sequential Custom Options).

#CRYSTALL BALL EXCEL TRIAL FOR MAC MANUAL#

#CRYSTALL BALL EXCEL TRIAL FOR MAC WINDOWS#

Real options analysis is used in situations where management has flexibility when making large capital budget decisions with high levels of uncertainty. The latest version of Crystal Ball is supported on PCs running Windows XP/Vista/7/8/10, 32-bit. It is an “option” because you have the right, but not the obligation, to invest. Why is it a real option? It is “real” because you are investing in operating capital and physical assets instead of financial assets. problems with Logitech Options, setting up on a Macbook Pro. I have to use Crystal Ball or RISK this time I dont want my students to be confused by ASPE. Finger-operated trackballs with center-mounted balls work for both right- and left-handed. ModelRisk then uses Monte Carlo simulation to automatically generate thousands of possible scenarios.Does: Real options analysis applies financial options theory to capital investments. Oracle Crystal Ball is a spreadsheet-based application for risk measurement and reporting, Monte Carlo simulation, time-series forecasting and optimization. Ive been teaching with the standard Solver in Excel. ModelRisk has been the innovation leader in the marketplace since 2009, being the first to introduce many technical Monte Carlo method features that make risk models easier to build, easier to audit and test, and more precisely match the problems you face.Ī ModelRisk user replaces uncertain values within their Excel model with special ModelRisk quantitative probability distribution functions that describe the uncertainty about those values. ModelRisk is a Monte Carlo simulation Excel add-in that allows the user to include uncertainty in their spreadsheet models.

0 kommentar(er)

0 kommentar(er)